how long does the irs have to collect back payroll taxes

Lets start with the good news. This is known as the statute of.

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

. Understanding collection actions 4 Collection actions in. After this 10-year period or. If you have not paid your taxes for several years or even for just one year you may owe back taxes to the state IRS or both.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. This time restriction is most commonly known as the statute of limitations.

How far back can the IRS collect unpaid taxes. For a lot of people that statement right there will help them breathe a sigh of relief. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF.

Our Sacramento tax attorneys are here to help you. Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years.

If you are unable to pay at this time 3 How long we have to collect taxes 3 How to appeal an IRS decision4. The IRS generally has 10 years from the date of assessment to collect on a balance due. How Long Does The IRS Have To Collect Back Taxes.

The IRS has a limited amount of time to collect back taxes. The collection statute expiration ends the. The IRS has 10 years to collect the full amount from the day a tax liability is finalized plus any penalties and interest.

There is an IRS statute of limitations on collecting taxes. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. A tax assessment determines how much you owe.

If you did not file. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection. The remaining balance disappears forever if the IRS.

Form 433-B Collection Information Statement for Businesses PDF. If you dont pay on time. How many years can the IRS collect back taxes.

How Long Can The Irs Collect Back Taxes Dollars Plus Sense

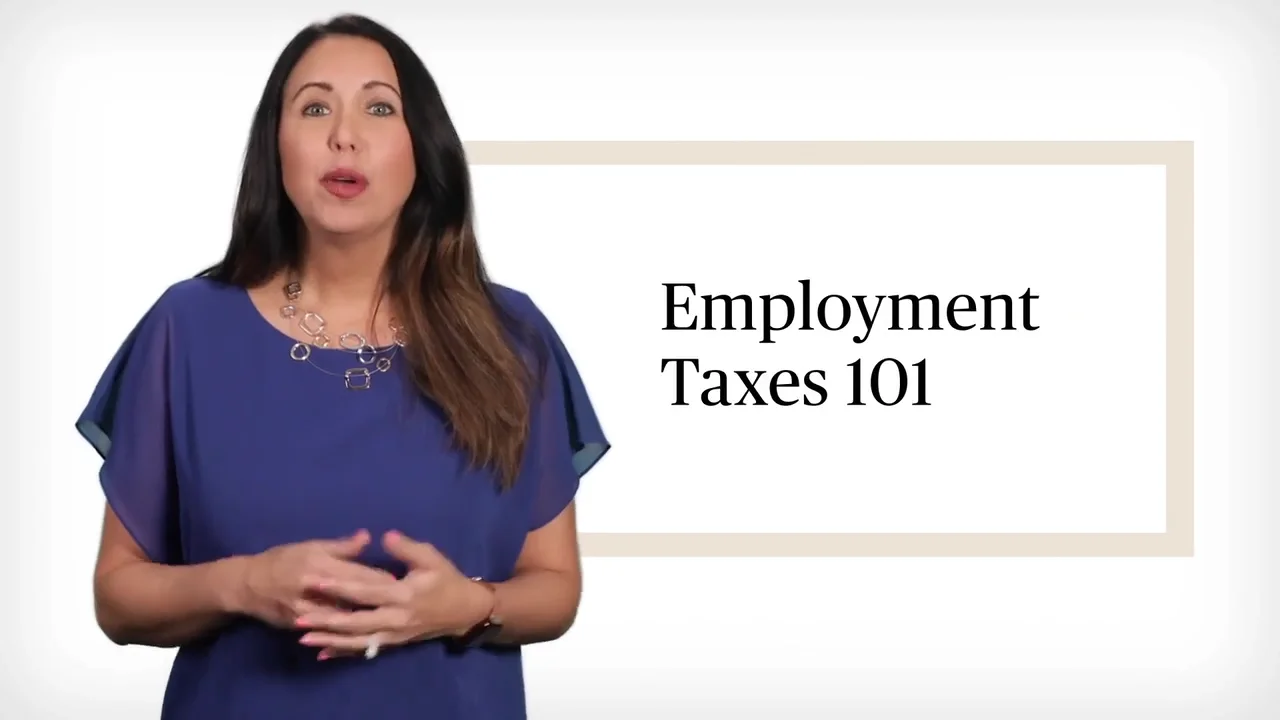

Employment Taxes 101 An Owner S Guide To Payroll Taxes

How Long Do Federal And State Tax Returns Need To Be Kept Turbotax Tax Tips Videos

Tas Tax Tip Understanding Your Csed And The Time Irs Can Collect Taxes

How Many Years Back Can The Irs Go In Its Search For Tax Fraud West Los Angeles California Irs Lawyer Dennis Brager

How To Sucessfully Negotiate Payroll Tax Relief With Irs

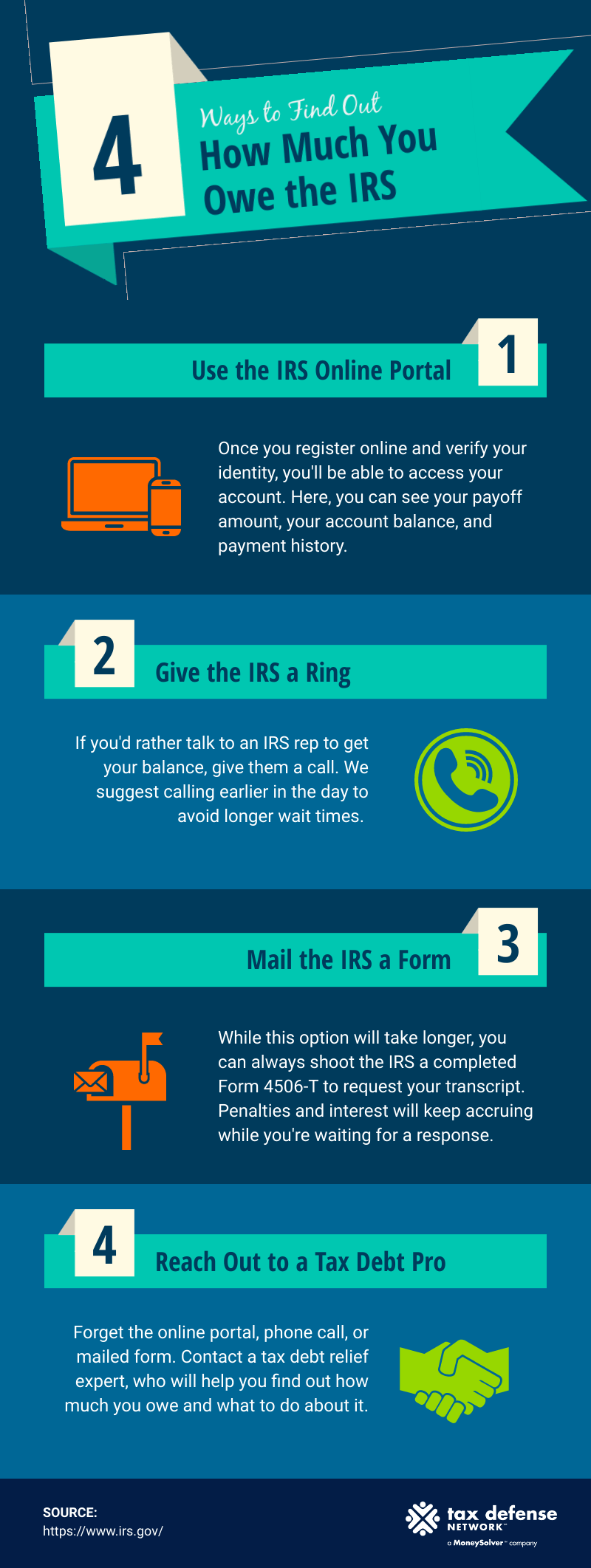

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

Payroll Taxes How Much Do Employers Take Out Adp

Are There Statute Of Limitations For Irs Collections Brotman Law

Help My Business Owes Back Payroll Taxes To The Irs

Can You Negotiate Your Back Taxes With The Irs

Explainer The 4 Trillion U S Government Relies On Individual Taxpayers Reuters

Will The Irs Collect And Seize My Home Or Assets Landmark Tax Group

Asset Seizure What Assets Can The Irs Legally Seize To Satisfy Tax Debts

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network